What Covid-19 Government Support is available to you? Report Provided By CoreLogic

The Product Data provided in this publication is of a general nature and should not be construed as specific advice or relied upon in lieu of appropriate professional advice. While CoreLogic uses commercially reasonable efforts to ensure the Product Data is current, CoreLogic does not warrant the accuracy, currency or completeness of the Product Data and to the full extent permitted by law excludes all loss or damage howsoever arising (including through negligence) in connection with the Product Data.

Amid an extraordinary economic slowdown, the Australian economy is heading for its first recession in almost 30 years. Indicators suggest this fall in demand is starting to weigh on the property market.

However,in attempt to soften the blow to the broader economy, a frequent stream of monetary, fiscal and social policies are rolling out. This will thus also help to insulate housing markets.

Over March, the JobSeeker was increasing payments to $550 per fortnight, effectively doubling the highest allowance. Additionally, on the 30th of March, there was an announcement of a $130 billion wage subsidy payment.

For eligible employers and employees, workers would receive a gross wage supplement of $1,500 before tax on a fortnightly basis. The game-changing package has led Westpac economists to reduce their forecast for peak unemployment from 17.0%, down to 9.0%. This will ultimately lessen downward pressure on housing demand. This is as more people are able to retain their job during and after the COVID-19 shutdown.

How many rentals are ‘affordable’ on the JobKeeper package?

The JobKeeper subsidy may also see fewer households fall into housing affordability stress. Housing affordability stress is a situation where households expend more than 30% of income on housing costs, such as rent.

You must consider the number of rentals available of servicing on 30% of the JobKeeper payment, to understand how many households may be better off.

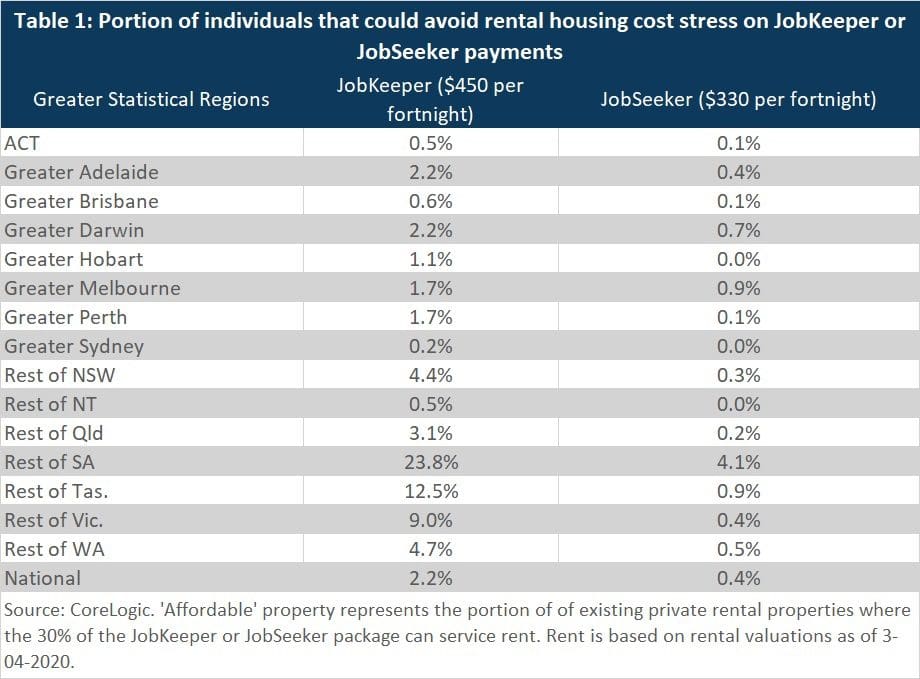

Table 1 shows the portion of the rental market in capital city and regional areas that could be serviced by an individual using just 30% of the JobKeeper or JobSeeker payments (i.e, what portion of the rental market can be rented for $450 per fortnight, or $330 per fortnight).

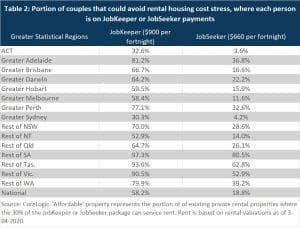

In considering typical household composition, Table 2 reflects the same analysis for a couple both receiving a benefit.

The analysis does not take into account tax on the JobKeeper payment, or voluntary employer top-ups of the JobKeeper amount.

What does the data mean?

The data highlights that the JobKeeper payments significantly increase the portion of affordable private rentals in Australia.

Flat payments are proportionately beneficial for renting households where rents are cheaper, such as in Regional Tasmania and South Australia. Incidentally, these are the areas that were possibly more impacted by the economic slowdown. This is in terms of the concentration of the labour force in agriculture, food service, tourism and accommodation.

But even with the relatively small portion of rental properties being affordable elsewhere, it is likely that current social distancing measures would see less discretionary spending, enabling a higher portion of income to be used in servicing rent.

Additionally, further protections for renters are in the works. On the 29th of March, federal and state leaders announced a 6 month moratorium on residential and commercial tenant evictions, for households in financial stress who cannot meet payments because of the coronavirus impact.

At a press conference the next day, Prime Minister Morrison made an allusion to further rental assistance. This includes a rent guarantee, but such details were still a work in progress. This would ease pressure on renters to service their full rent commitments, however the impact on landlords remains uncertain.

Another note on this data is that it reflects rental valuations as of early April. As income and job prospects decline, the private rental market will likely see a downwards adjustment. This could be due to landlords of vacant properties potentially having to lower rents in order to meet the market.

A final takeaway from this data is that now is an opportune time to explore social and affordable housing supply. The government could look to create housing supply that compliments the payments offered to renters in addition to the benefits to the construction sector.

What’s next?

Find out more about what you can do as you navigate through these difficult times.

If you want to know more about your Covid-19 government support options? Please leave your details below and we will be in touch.