With a huge portion of people losing their jobs as a result of the pandemic, there have been roughly 100,000 more young investors since March 2020. Some millennials claim to have tried saving by banking up interest but that small interest rate just isn’t enough, and so they have turned to stock trading. Many are even investing in international mainstream brands such as Apple, Netflix and Facebook and making thousands of dollars in profits.

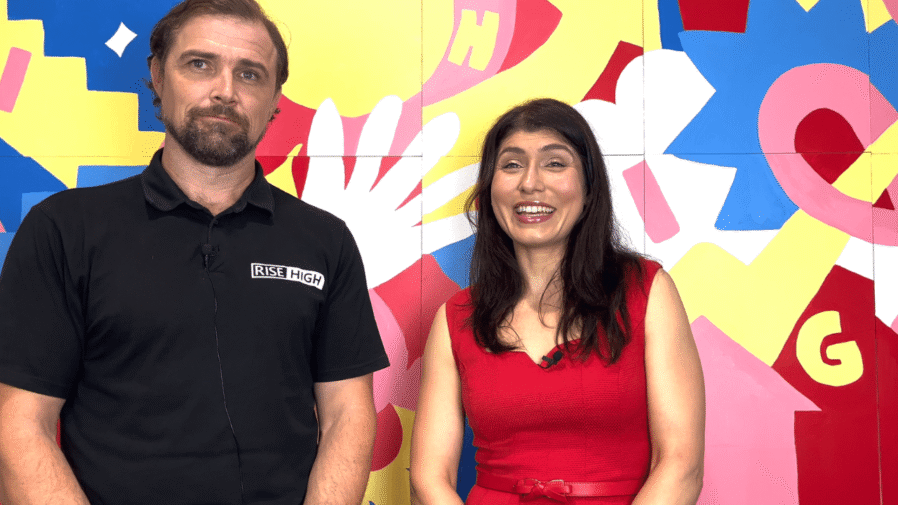

Just earlier we spoke with Marissa Schulze from Rise High Financial Solutions talking about the influx of young investors within Australia.