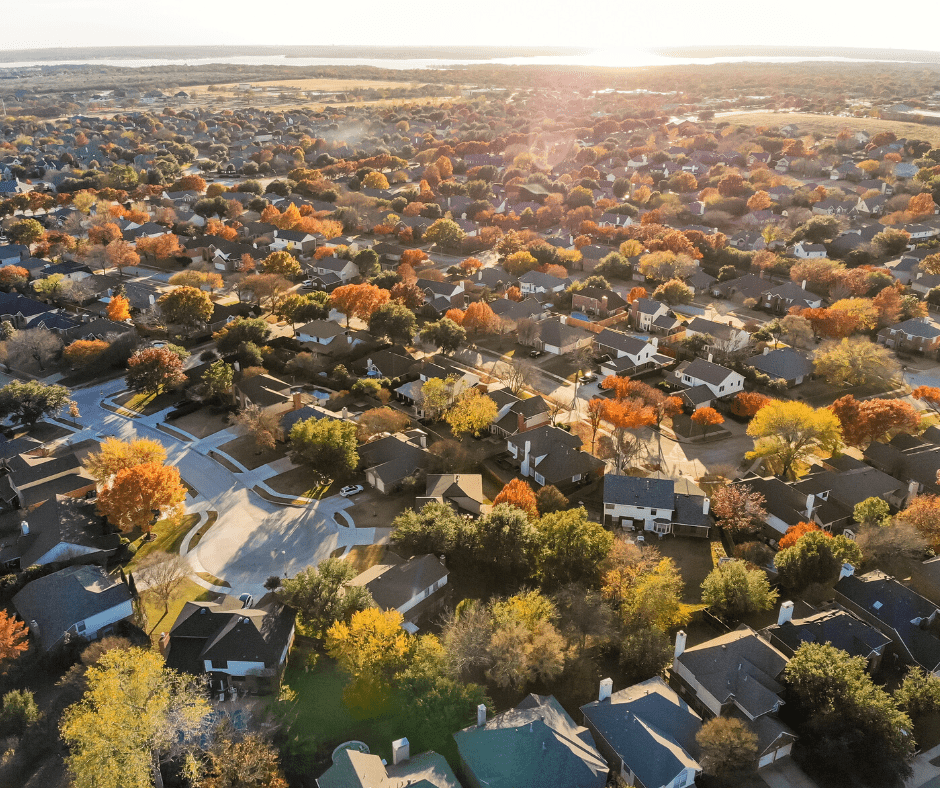

The suburb you live in or want to buy in means more than you might think. Not only is it important to you, it could also be important to your bank.

You bank will look at 3 things when you apply for your loan:

- ability to service the loan

- credit history and credit score

- types of security

For this blog we are focusing on number 3. The type of security essentially means what type of property you want to buy and where that property is located.

Three low security areas

To start there are three general areas where a bank may not be as hasty to give you that loan and if they do it will a be a very low percentage.

First, high risk areas. These are areas where the high risk is the property value. These are generally regional or remote mining towns or just small towns in general who aren’t supported by more than maybe one or two industries.

Second, areas the bank might believe are in oversupply of property. You might see this in capital cities or high density apartments styles. These types of developments can pose a risk of oversupply opening the bank to extra risks, including the 3rd area.

Third, specific banks may avoid areas they are already servicing. If you’re looking to buy in an area that is over serviced by a bank, they may deem any further loans as over exposure. They will usually try to limit the percentage of properties in one area to reduce their own risk.

Popular postcode can mean low security

You might be surprised that the CBD can be some of the lowest security areas to get a home loan. But the banks don’t like oversupply.

This lack of security might mean the banks have loan-to-value restrictions. This could really affect your loan! This means there is a lower lending percentage against properties, high-density apartments, or units in blocks with more than 10 apartments or units.

So if you’re looking to buy in the CBD you might only get 80% or 70% of the value of your property, low right! Compared to the 90 to 95% you might usually get that can be a heart breaker.

What can you do

If you have your heart set on that city center apartment with the amazing view, don’t worry! Just make sure you’ve spoken to your Rise High mortgage broker first. We can tell you how much you’ll be able to borrow.

This doesn’t mean you can’t get a home loan, construction loan or property investment loan if you’re looking to buy in any of these areas. It just means you might not get the loan you initially wanted. But that’s ok! We can help you plan for the larger deposit you’ll need to get into that dream home.

Just make sure if you’re looking to purchase your property that you’re being proactive. Have an idea of the postcode you want to buy in and how much you need to borrow before you make an offer.

If you’re worried you could be looking in these areas contact us here or leave your details below and we can help you figure out what’s best for you!