As a property investor it is important to understand what records you need to keep and what you can claim for your investment property to maximise your tax deductions. Here is list of the most important things to remember:

1. Keep Records

You’re probably a really busy person, so we can’t expect you to remember everything!

It is important to keep records of all your income and expenses related to your investment property to ensure you maximise returns. These can include receipts for purchases, bank statements and property management documentation.

2. Property management fees

If you’re what we like to call ‘a lazy investor’, then you like the set it and forget it approach to your investment properties. All the income and none of the hassle right!

Most investors hire a property manager to manage their property. Other than conducting house inspections, they can also assist with paying expenses associated with that property. For example, advertising fees, council rates, water rates, repairs and maintenance, strata fees, cleaning, gardening, land tax, and insurance premiums. All the expenses we just mentioned will be listed on monthly and/or annual statements. And if that’s not enough, the fees that you pay to your property manager are tax deductible too.

3. Interest on loan

The common misconception for this expense is that investors who have a principal and interest loan assume that the whole portion of the repayment is tax deductible. Only the interest portion of the repayment is tax deductible. Some banks send an annual statement of the total interest paid on the loan to customers. This makes it easier for investors to claim this expense. Those that doesn’t would have to collect the loan statement for the year and add up all the interest expense associated with the loan.

4. Capital works and depreciation

The amount of money you spend both inside and outside the property is tax deductible. But, the full amount is not always immediately deductible in the year you spend it.

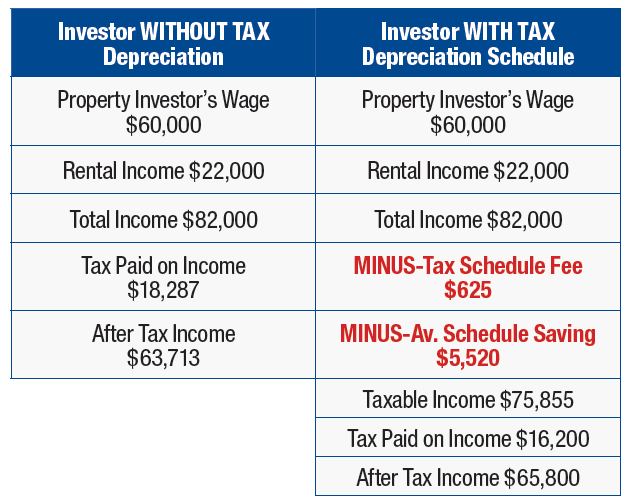

Everything you purchase has a useful life, the amount you can claim on those items is divided over those years. This is what we call depreciation. We don’t expect you to know or work out the useful life of every item you purchase, luckily, there’s professionals for that. Quantity surveyors are ATO approved professionals that visit your investment property, inspect the assets that are depreciable, and prepare a report that contains depreciation figures for you or your accountant to include in your tax returns. It gets better… the fees you pay the quantity surveyor are also tax deductible.

5. PAYG Withholding Variation

If you have negatively geared properties, you’ll be used to having to contribute more of your own personal funds into holding the property to receive a nice tax refund from the ATO at the end of the financial year. However, if you are receiving a lump sum tax refund it basically means that you have overpaid tax for the year and the ATO owes you money.

Instead of waiting for this tax refund (and giving the ATO an interest free loan), you could be better off getting this tax refund paid to you throughout the year. You can do this by varying your withholding tax (ie. Reducing the amount of PAYG tax that your employer withholds each pay).

6. Miscellaneous

These are the minor expenses that investors incur while holding the property, but often fail to realise are tax deductible.

Tax deductible expenses will include things like stationery, telephone and postage. For example, if you have made a phone call to your tenant or property manager in relation to the investment property, the amount of money spent on that phone call is tax deductible. However, again, you would need to keep a record of that. You can also claim pens, paper, folders, or any stationery that’s used to manage the property.

Each investment property is unique so talk to your accountant today to find out what you can claim! As your trusted mortgage brokers, our team at Rise High can also help by reviewing your existing loan or evaluating your refinancing or debt consolidation options, ensuring you make the most out of your investment and hard-earned money, on top of any tax deductions you may be looking forward to claiming.

If you would like to know more, get in contact with us here or leave your details below!